By Shane Garrett, Senior Economist, Housing Industry Association

During 2015, Australia’s new home building industry broke all previous records to smithereens with 221,000 new dwelling starts during the year. This represented an increase of 11.0 percent on the level of 2014, then a record of 199,000 new home commencements.

The all-time high level of building is not the only unique feature of the current new home building cycle. The multi-unit category (which includes all dwellings apart from detached houses) accounted for just under half (48.5 percent) of total dwelling starts. Moreover, the sheer duration of the upswing of the current cycle – spanning some 15 quarters from trough to what we expect to have been the peak – is among the longest since the 1980s.

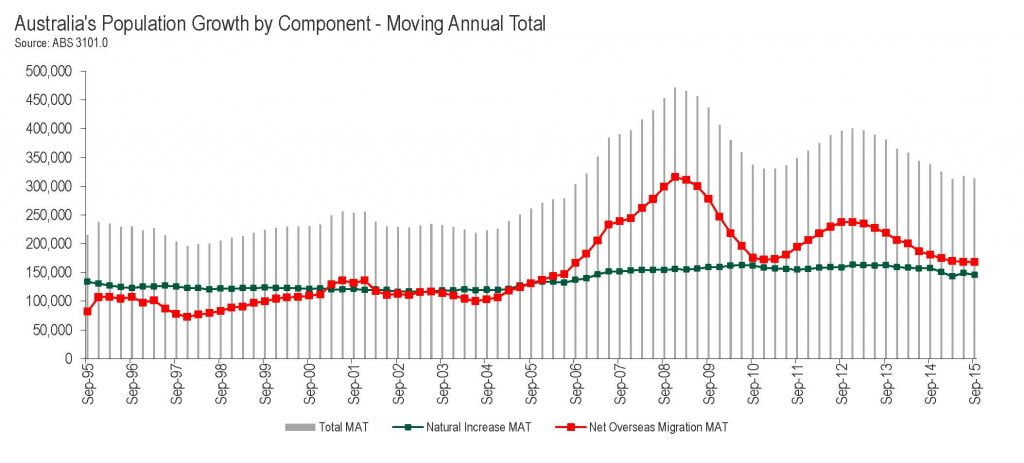

The size of the population is the single most important driver of new home building activity. At the end of the September 2015 quarter, Australia’s population was estimated at 23.86 million, some 313,200 more people than a year earlier and equivalent to a 1.3 per cent annual increase. The increase was split fairly evenly between natural increase (births minus deaths) and net overseas migration. Births exceeded deaths by 145,600 over the 12 months, while net overseas migration added another 167,700 people to Australia’s population.

Overseas migration is the most immediate driver of housing demand and its volume has been in decline since about 2012. This has contributed to a steady reduction in the rate of population growth from 1.8 percent at the end of 2012 to 1.3 percent according to the latest figures for the year to September 2015.

The sharp fall-off in overseas migration to Australia can be traced to the relative performance of Australia’s labour market compared with other advanced economies. It is no coincidence that migration flows to Australia peaked during the 2008-09 period, a time when labour markets in the northern hemisphere were in rapid deterioration while Australia’s was holding up well. Today, Australia’s labour market is marked by a higher-than-desirable unemployment rate at the same time as labour markets in the US, the UK and some European economies seeing steady improvement.

Despite unprecedented volumes of inward migration between 2008 and 2013, new home building volumes remained modest. The build rate over this period was only about 156,000 homes per year, much lower than the 180,000 homes a year HIA estimates are needed to house Australia’s ever-growing population.

It was only since mortgage interest rates fell to very low levels in late 2012 that there was strong enough impetus for the industry to start catching up with the pent-up demand for housing and take construction to the current record levels. The acceleration of dwelling price growth in the key markets of Sydney and Melbourne also made the backdrop to new home building activity more supportive.

Drilling down into the geographic dynamics of the upswing in new home building shows the situation is by no means universal. Driving the early stages of the upswing were New South Wales, Western Australia and, to a lesser extent, Queensland, while Victoria and Tasmania took longer to kick into gear. The South Australia recovery lost steam prematurely, while conditions in the both the Northern Territory and the Australian Capital Territory have generally been out of sync with the national cycle.

Wide regional divergence in new home building conditions continued in 2015, with the eastern seaboard states being the key states driving the record level of building nationally. Victoria, NSW and Queensland accounted for 78.7 per cent of Australia’s total dwelling commencements in 2015.

In terms of the outlook, 2016 is likely to see a reduction in new dwelling starts from 2015’s record levels. Commencements are forecast to fall by 9.2 percent this year to about 200,000, which would still make this year the second strongest on record. A larger reduction is projected to kick in in 2017, with starts expected to decline by 16.7 percent to 166,600. The cycle is then expected to bottom out in 2018, with 160,680 new dwelling commencements forecast. The bulk of the reduction in new home building is anticipated to be borne on the multi-unit side of the market. From 2019 onwards, a modest recovery in new home building activity is projected to take hold.