With an emphasis on local supply, Multinail has helped its customers get through a difficult year. We look at lessons learned and what they mean for Australian F&T and manufacturing.

Forty-one years ago, when Peter Taylor founded Multinail, he pushed through a run of bad luck in the early days of the business, including a semi-trailer laden with nail plates rolling at the start of the Easter weekend. Knowing there were fabricators waiting for that product, he called in his stamping team and they gave up their holidays to make sure the plates made it to the fabricators in time.

Much more than being a nice story about good customer service, it became a key part of the company’s business strategy: always have the product available.

Supply for support

The past 12 months have tested a lot of supply lines around the country, from timber to plates, machinery and parts. However, for Multinail: “I can’t think of any hold-ups we’ve had with products or parts this year. It just didn’t happen,” says Danny Fleetwood, ACT and NSW business development manager.

“We’re mindful about sourcing locally, and that extends to doing maintenance or repair jobs on a machine, we’ll try and source as much as we can in that local market.”

This very much extends to the nail plates, which are still manufactured locally, now at the company’s Stapylton headquarters.

“A majority of our steel is from Australia,” says Dean Hook, stamping operations manager. “We do take a few parcels of imports, but a majority is local material. We don’t put 100% of our eggs in one basket to help with both price and reliability of supply.”

The Multinail Australian steel supply order hovers around 80% in a normal year and can quickly be ramped up to 100% in a year like 2020. While steel isn’t TTN’s favourite material, there’s no doubt about the importance of nail plates to framing timbers, and that security of supply has been important to help keep mainstream construction ticking over.

“We always forward plan our usage, so we have bulk store in stock,” Hook says. “I’ve seen other industries, like garage door manufacturers, affected, but we’ve been fine. Even in a normal year, we plan out by six to nine months, so we haven’t been affected by anything this year: we’ve just been conservative through our stock and planned well.”

Not all the other nail plate companies have had the same year.

“We’ve definitely had an uptick in enquiries from new customers,” says Hook, “whether they be hardware customers or truss plants unable to get supply from their current suppliers. We’ve been able to help them out – everyone knows we manufacture locally and say that’s reliable, so we need to do what we say.”

The other side of Multinail’s core business, the machinery sales, is a more complex story, says Trent Taylor, chief operating officer.

“We’re developing the machinery systems that truss plants need to produce their products efficiently. When it comes to our more sophisticated parts, like robotics and motion control systems, some of that does come from overseas,” he says.

“We’ve been fortunate that the various issues with importing haven’t had an impact on us this time, but where we get supply from is something we’re looking at.”

Taylor says it’s an industry-wide issue. On the one hand, the world will always be interconnected, but on the other, we’ve seen the very clear need for fail safes. Whether that leads to companies sourcing supply from more countries to reduce reliance on just one or two, or to more manufacture in Australia is something that Taylor is, like the rest of us, waiting to see.

“I wonder about the strategy of our technology suppliers. Will they see import as a barrier and choose to set up local manufacturing?” Taylor says. “I don’t know. We came through Covid very well, but that’s not to say we shouldn’t be looking at suppliers that are more home-grown and become less reliant on imports, I think it’s a fair strategy for any business.”

Growing business

Multinail’s success is built on the successes of its fabricators. As a result, the company works closely with them.

“A lot of people have been having a rough time,” Fleetwood says. “At the best of times, it’s a high-stress industry. One thing I like about this company is there’s no question if you just sit down and have a drink with a customer. Most of us come from a fabricating or timber background and we know that sometimes you just need to offload, whether that’s about staff, Covid, inadequate building plans…”

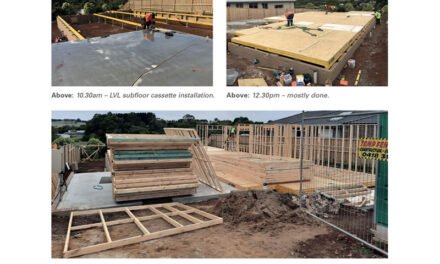

The title ‘business development manager’ isn’t one-way: Fleetwood actively looks for opportunities for his customers. “At the moment, we’re pushing prefabricated elements like floor joists and floor cassettes,” he says. “They’re getting a fair bit of traction because they have multiple benefits. For example, the fabricator can utilise more of their offcuts in floor joists. So with the linear saws now, you can optimise to cut your web verticals. That means more manufacturing, so it’s a win-win situation. And you’re taking the competitive edge away from I-beams.”

Fleetwood acknowledges I-beams can work well, but says they’re not a universal solution. “I work with a few big builders, one in particular, who won’t use them anymore because they have issues with plumbers and electricians coming through and putting service holes through the joist where they shouldn’t,” he says.

“They don’t want to keep paying for those rectifications, so one of our customers has just started manufacturing floor systems for them with our EcoWeb.”

It’s just one of the problems that have grown out of Australia’s individual state-based building systems, Fleetwood says.

“Theoretically we’ve got an open trade system here,” he says, “but one of the big problems in our industry is that every state has different processes and different requirements at a building planning and approval stage. For example, Queensland has mandatory bracing and tie-down requirements at plan drawing stage, so any structural issues are identified early on. In NSW, that often falls back onto the frame or truss plant that’s going to win the job, and they usually don’t get paid for it.

“I pat the FTMA on the back, here, because if you look at how Victoria operates, the fabricators work together as an industry. Sometimes in NSW, we’re a bit more competition focused. Right now, there is more of a sense of cooperation as we try to recover. We’ve shifted away from decisions being driven only by price, even in NSW, but whether or not that holds for the long term is the question, and it’s hard to answer.”

Change is coming to fabrication across Australia, ready or not. Some of this is being driven by architecture trends – “Roof spans are getting smaller as the build lots are getting smaller,” Hook says. “So instead of people having larger one-storey houses, they’re going upwards. We’re seeing smaller roofs, but more walls and floors, so less in the way of trusses, but, as Danny says, more frames, cassettes and joists.”

It’s also coming at the manufacturing end. “Connectors have changed little from day dot,” Hook says, “but there’s been continuous improvement in our processes and how people use them. Now we’ve improved our tooling and are looking at introducing more automation.”

It’s that automation that is the real game changer for what can be done in an F&T plant. Multinail has long specialised in providing software that can design around common problems such as supply issues – “Just turn off the sizes, grades and lengths that aren’t in stock and the program automatically works around that,” says Taylor.

But now it’s also in the process of delivering products that use more sophisticated automation in a bid to help fabricators manage both skills shortages and complex jobs. And doing so in such a way as to avoid complete reliance on imports.

“Technology and access to the tools to develop it are so ubiquitous now,” Taylor says. “I mean programming languages, access to motion control, access to vision systems… it’s all available and being supplied locally as well as overseas.

“What that means for us is that we’re not beholden to one company or country. We use software tools that are developed in the US, but we use those tools to write software in Australia. We use motion control that’s developed in Japan, but in Australia we adapt that to our machines. We’re using robots from Germany, but in Australia we bring them in and they form a part of our upcoming automated machinery range.

“All those little bits of technology – a lot of which don’t require things being shipped in containers on boats – enable us to develop technology here as a total solution for the local frame and truss industry. We develop it, and we’re local, so we can service it. I think that’s the real secret sauce.”

Power of people

At the heart of all this are Australian jobs. The construction industry’s role as a jobs multiplier is well known, and Multinail both supports that and benefits from it.

“We’ve got about 30 full-time staff in just the stamping operations,” says Hook.

“We also have an apprenticeship program. These are toolmaker apprentices and we’re currently training our third batch. As they qualify, generally in a four-year cycle, depending on what’s happening at Multinail, we either keep them on or they move onto other jobs and we get a new batch in. They can take those skills into general engineering shops, into plastics, rubber, die casting – pretty much anything!”

Multinail has been fortunate in not needing large layoffs in the shadow of Covid, but things have definitely changed over the past year. “We’ve been forced to become more efficient and measure people more this year,” Taylor says.

“I think that Covid has allowed us to implement five years’ worth of information systems within our company in five months. We were able to roll out communication systems and collaboration systems so quickly and with very little resistance, because people understood the situation, that we needed these to be in place so they could work remotely and do their job.”

That’s led to what Taylor describes as a rationalisation of the workforce, rather than a shrinking of it. “We’ve maintained very similar numbers,” he says, “but the efficiencies point out where we can be doing even better with our employees and where employee numbers are over- or under-subscribed. It’s been a real wake-up call in making sure that we’re lean at all times, not just in terms of the pandemic.”

He knows that this year of prioritising communications, often at a distance, will make changes to the way the company does business in the future, but exactly what those will be are still becoming clear. “How this flows into our software systems and so on I’m not yet sure,” Taylor says. “I’d be a fool to say that it’s not going to have an impact or influence on where we develop our technology in the future.”

Holding onto change

It’s been some months now since most people have been talking about snapping back to normal. Instead, the Multinail team are looking at where they see the ‘new normal’ landing. Across the organisation there are visions for how the past year can become positive in its legacy.

“I hope we see fabricators with more confidence that investment will bring returns,” Fleetwood says.

“It’s all about gaining the efficiencies – and OH&S, too. With the linear saws, for example, you’ll get a return on their efficiencies, the volume of product they can cut and in taking away the risk of someone injuring a hand or finger. We had one customer who’d had two shoulder injuries in his team over a short period of time. With any injury now, you pay the first $150,000 of any claim over three years. That’s $50,000 extra going onto your premium each year. He was sick of it, so he invested in two PieceMaker linear saws, one for each plant, and explained them as only costing two injuries apiece. That’s how you’ve got to look at things now.”

Hook would like to see the increased focus on local supply stay long after 2020. “Everyone just assumes that import’s cheaper,” he says. “But I think we’ve shown that we can hold our own. This year’s been pretty advantageous to us.”

Fleetwood agrees, saying: “We’ve got to re-establish ourselves as a manufacturing country. I like being able to say that Multinail is already a part of that. Our customers are very loyal, because they see the clear benefits they get, as well as perhaps feeling a bit more protective of our own manufacturing than they were pre-Covid.

“I had a customer text me at 5.30am yesterday, they had a seal blow on their table press and I didn’t see the message until 8.30. I got onto our machinery manager Peter Whitley and he got onto Gavin, our NSW machine technical support officer, he was in Sydney and by midday, he was at the customer’s yard and had fixed the machine. If that was an overseas machine, you wouldn’t get that speed of response. It’s not only where it’s made, it’s where it’s maintained, how it’s serviced and how responsive the company is. With Multinail, I think that’s a real asset.”

Taylor’s vision of the near future is both more expansive and more poetic. “I just think that we’ll look at things differently,” he says. “Certainly in our social interactions, there’s a new norm to get used to, but for business, while it’s been unpleasant, it’s probably been the winter we had to go through in order to create the rebirth.

“It’s kind of fitting that in the timber industry, a tree is the most fitting metaphor. You go through a winter, you shed off the old bark and you come out the other side in the spring and the new growth starts. I feel as though many parts of our business and our customers’ businesses are in that phase, it’s an exciting time, to be honest.”

For more, visit www.multinail.com

Image: Three of the team members at the Multinail Stamping Plant, who are responsible for many of the metal connectors holding Australian housing together. (Courtesy Multinail)